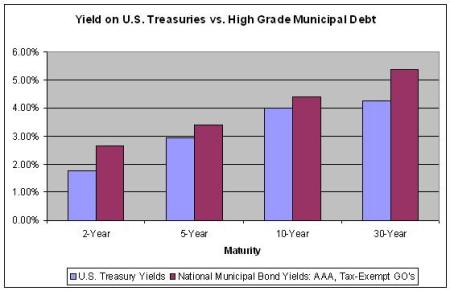

If Clara Peller, the adorable “mature” woman from the infamous Wendy’s commercial had been a municipal bond broker, she’d be asking: “Where’s the bid?” At the current moment, municipal are trading “wider” to treasuries despite their tax-advantaged status, a rare-ish event.

Along with the rest of bathwater, municipal bonds have been tossed to the curb. While some of the selling is forced due to the massive unwind, there has been and remains growing speculation that a number of American cities will be facing solvency issues of their own.

The confluence of events are all good reasons to be concerned about municipal debt: 1. declining corporate tax bases due to the dissolution of major corporations or the pending effect of the financial crisis on real earnings, 2. the prospects of higher unemployment and possibly stalled or declining wages which translates to less revenue from taxes on earned income, 3. declining property taxes resulting from declining real estate values, 4. lower consumption from consumers looking to rebuild personal balance sheets through higher savings rates, which translates into lost sales tax collected 5. higher government spending at the federal level which could put pressure on federal support to municipalities, 6. uncertainty remaining in the muni insurance market, and the “other shoe” that would drop for insurers if large amounts of municipal debt failed and insurance policies were called in for redemption.

Let’s remember though that muni debt comes in two varietals: revenue bonds used to fund infrastructure projects and general obligations bonds backed by the local taxing authority.

Let’s look at revenue bonds, that are tied to things like toll roads, sewage systems, health care or educational facilities. Revenue bonds get hurt in times like these because investors fear that the projects backing the revenue bonds may fall short of the income needed to service the debt. While the concerns are valid, and due diligence ought to be done, unless we all lock ourselves in our houses, it is less than likely that the dire scenarios painted by current municipal bond pricing will play out.

Add to that the large number of institutional investors who have been drooling over the idea of building “infrastructure funds”. These are large pools of private equity looking to take some of these revenue projects off of the balance sheets of municipalities, effectively privatizing large parts of the commons. One can argue, either way, if this is a good idea. Pragmatists would say that the option may become a good one for municipalities facing fiscal pressure over the next few years.

With regard to general obligation bonds, there is obvious concern for municipal defaults if municipal income becomes dwarfed by expenses that are likely to have ballooned through this last bull cycle. However, municipalities by definition have the power to tax. As such, and in theory, they can collect whatever they need to meet their general obligations. Now in practice it is not that simple, since residents can choose to leave higher taxed cities in favor of others with more accommodative policies. Nonetheless, there will be some margin of elasticity for residents to pay higher taxes given the tangible and intangible costs of moving.

This leads us to the last point, which is if we accept that federal taxes in some form are going to be higher in the years ahead to pay for the TARP, (or whatever other major spending plans become approved) municipal debt has a call option, if nothing else, for the fact that its taxable equivalent yield is going to increase.

That said, I don’t know where the absolute price of muni’s will be in the future, but I am certain that they will once again trade closer to in line with historical averages (higher prices with lower yields) once the markets settle down.

“Municipal bonds normally trade at about 80 per cent of Treasury market yields because they are tax-free investments.”

Sources:

Municipal bond yields at historic highs

Michael Mackenzie, Saskia Scholtes, Financial Times, March 3 2008

http://us.ft.com/ftgateway/superpage.ft?news_id=fto030320081848181708

Chart: Treasury vs. Muni Yields

(All data sourced at bloomberg.com/markets/rates/ at 2:20PM on October 14, 2008)

http://www.bloomberg.com/markets/rates/index.html

[…] Read the rest here: Municipal Bonds: A Conundrum […]

[…] further interesting reading on Munis see Municipal Bonds – A Conundrum and Are Municipal Bonds the Next Shoe to […]