How far we’ve come and how far we’ve got to go in the large deleveraging taking place is really anyone’s guess. New statements by Nouriel Roubini, Nassim Taleb, and other prescient doomsayers are now offering new bearish scenarios of epic proportion, with thousands of hedge funds winding down and risks to all systems as we know them.

A recent PBS interview with Taleb and his mentor Benoit Mandelbrot, has caused great concern. In this broadcast Taleb and Mandelbrot asserted that this crisis could be far worse than the Great Depression. When pressed on that statement he references the American Revolution as a better comparison of where we may be headed.

NASSIM NICHOLAS TALEB: I don’t know if we’re entering the most difficult period since — not since the Great Depression, since the American Revolution.

I happen to believe in the assertion that thousand of hedge funds will wind down, as I noted in an earlier post called Outbreak. Alternatively many funds will likely reincarnate as well, in order to capture carry charges on appreciation which they have given up by way of high-water marks.

While I am appreciative of the more dire scenarios, as we should be aware of what might happen in order to be prepared, I am cautiously optimistic that there wont be blood in the streets. Pragmatically, in a worse case scenario, there is incentive to be in cash early, which many have done already. Alternatively, there is incentive to be invested early if one believes we are near a bottom. The uncertainty in between those to ideas ought to continue to help markets find an equilibrium, however rocky that road is.

Nonetheless, large amounts of disturbing information continues to support Taleb, Roubini and others. Because of them, people like me are able to notice many of the signs that support bearish sentiment, and to appreciate the dire concerns. More importantly though, their work ought serve as a reminder for all of us to remain empirically pragmatic, as Taleb encourages, in all of the news, pundits and data we see.

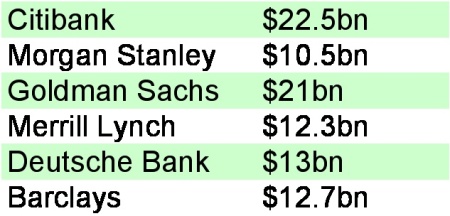

I offer the chart below both as perspective of one of the catalysts that has accelerated the current fire: the fall of Lehman Brothers. From one point of view, the chart below raises an eyebrow because Lehman was only the 7th most leveraged financial firm as of June 2008, leading to a concern that Lehman’s fall was small potatoes. On the other side, the rest of these firms have received implicit guarantees by their home governments that failure will be averted, at any expense, paving a road for recovery.

Borrowing Binge: European Banks Carry Big, Scary Leverage Ratios

In contest to the gloomiest assertions and unlike the great depression, governments worldwide are acting early, quickly in a coordinated fashion. And unlike the American revolution, this is not a fight for independence, but for the sustainability of globalization, which as nasty as this moment is, has afforded over a billion people a peek at a better living standard. Furthermore, unlike both of these events, Americans are quite unlikely to be out of food and shelter by the millions, and as such the taking up of arms, in this country, strikes me as impossible.

Whether this chart offers hope or gloom is only commentary. Only the future will make that point clear. What do you think?

Sources:

Experts Examine Future of Credit Crunch

The Newshour with Jim Lehrer, October 21, 2008

http://vvi.onstreammedia.com/cgi-bin/visearch?user=pbs-newshour&template=template.html&query=Experts+Examine+Future+of+Credit+Crunch&keywords=Experts+Examine+Future+of+Credit+Crunch&category=blank&submit.x=0&submit.y=0&submit=Search

Barclays: Wall Street’s new gambler

Peter Gumbel, Barney Gimbel, Fortune, October 21, 2008

http://money.cnn.com/2008/10/19/news/companies/barclays.fortune/

Posted by greenewable

Posted by greenewable